Welcome to our comprehensive guide on the various types of insurance! Whether you are a complete beginner or looking to expand your knowledge on the subject, we’ve got you covered. Insurance plays a crucial role in protecting individuals, businesses, and assets from unforeseen risks, making it essential to understand the different types available. In this guide, we will explore the fundamentals of insurance, delve into the various types, and provide valuable insights to help you make informed decisions. Let’s embark on this insightful journey into the world of insurance.

Understanding the Fundamentals of Insurance

Before diving into the specific types of insurance, it’s important to grasp the fundamental principles that underpin the concept. At its core, insurance is a contract between an individual or entity (the policyholder) and an insurance company. The policyholder pays a premium in exchange for financial protection against certain risks. In the event of a covered loss, the insurance company provides compensation to help mitigate the impact.

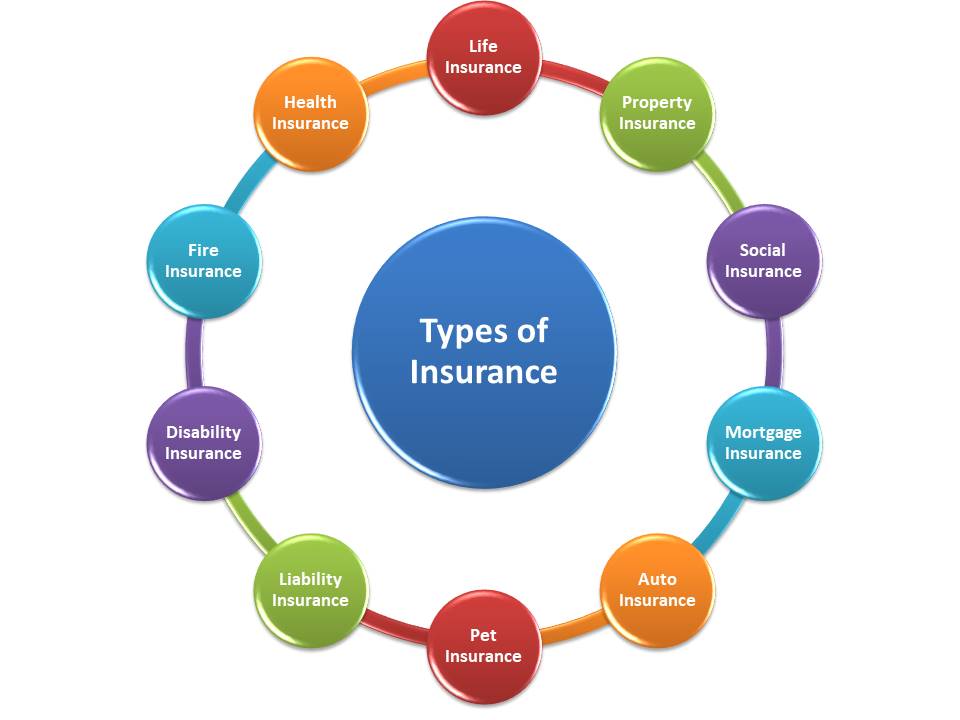

Types of Insurance

1. Life Insurance

– Life insurance provides financial protection for the policyholder’s beneficiaries in the event of their death. It helps ensure that loved ones are financially secure and can cover expenses such as mortgage payments, outstanding debts, and future living expenses. There are various types of life insurance, including term life, whole life, and universal life policies, each offering unique features and benefits.

2. Health Insurance

– Health insurance is designed to cover medical expenses, including hospitalization, doctor visits, prescription medications, and preventive care. It offers peace of mind by helping individuals and families manage healthcare costs, thereby promoting overall well-being.

3. Auto Insurance

– Auto insurance provides financial protection in the event of vehicle-related accidents, damage, or theft. It typically includes coverage for liability, collision, comprehensive, and uninsured/underinsured motorist protection. Auto insurance is mandatory in many regions and is crucial for safeguarding both drivers and their vehicles.

4. Homeowners/Renters Insurance

– Homeowners and renters insurance offers protection for residential properties and personal belongings. It covers damages caused by perils such as fire, theft, vandalism, and natural disasters. Additionally, liability coverage is included to protect against legal claims arising from injuries or property damage on the premises.

5. Business Insurance

– Business insurance encompasses various types of coverage tailored to protect enterprises from potential risks. This includes property insurance, liability coverage, business interruption insurance, and specialized policies for specific industries. Business insurance is essential for safeguarding assets and maintaining operational resilience.

6. Travel Insurance

– Travel insurance provides coverage for unexpected events during domestic or international travels. This may include trip cancellation/interruption, emergency medical assistance, baggage loss, and travel delay compensation. It offers reassurance and financial protection for travelers facing unforeseen circumstances.

Making Informed Decisions

When considering insurance options, it’s vital to assess individual needs, evaluate potential risks, and explore different policy features and coverage limits. Each type of insurance offers specific protections, and understanding the nuances will help in making informed decisions. Additionally, working with reputable insurance providers and seeking professional guidance can further enhance the decision-making process.

Conclusion

Insurance serves as a safety net, offering financial security and peace of mind in the face of unpredictable events. By familiarizing yourself with the various types of insurance and their respective benefits, you can take proactive steps to protect what matters most. We hope this comprehensive guide has equipped you with valuable insights and empowered you to navigate the world of insurance with confidence. Remember, knowledge is key, and staying informed is the first step towards securing a resilient future.