From being a specialized technology, cryptocurrency has grown to become a significant economic force. Discussions concerning how it might transform industries, financial institutions, and economic policy have been triggered by its rise. The key to comprehending the global economic impact of cryptocurrencies is to comprehend their complex effects on financial markets, economic inclusion, regulatory frameworks, and established sectors.

Financial markets have changed as a result of the rise of Ethereum and Bitcoin. Digital assets have created a new investment class that attracts individual and institutional investors. Speculators have flooded in due to the extreme price volatility of cryptocurrency markets. Despite the risks, volatility has sparked innovation in financial services such as cryptocurrency exchanges, investment funds, and trading platforms.

Cryptocurrencies have gained legitimacy in the global financial system due to their use by large corporations and institutional investors. Bitcoin is a payment method or asset used by Tesla, PayPal, and Square. Financial institutions are now able to use cryptocurrencies because of their broad acceptance, which has raised investor confidence and market stability.

The global economy depends on financial inclusion, which Bitcoin can increase. Underprivileged communities are occasionally left out by traditional banks, particularly in developing countries. Non-bankers can participate in the financial system thanks to cryptocurrencies. People can deal with money, store digital assets, and access financial services thanks to mobile and internet technologies. By providing financial empowerment to underserved communities, this inclusion can accelerate economic growth.

The influence of cryptocurrencies on the world economy has increased due to decentralized finance. DeFi systems provide lending, borrowing, and trading without the need for middlemen by utilizing blockchain technology. These platforms offer consumers more affordable and effective financial services through transparent and open standards. Conventional banks and other financial institutions have been forced to quickly adjust to the new investment and financial transaction patterns brought about by DeFi’s rise.

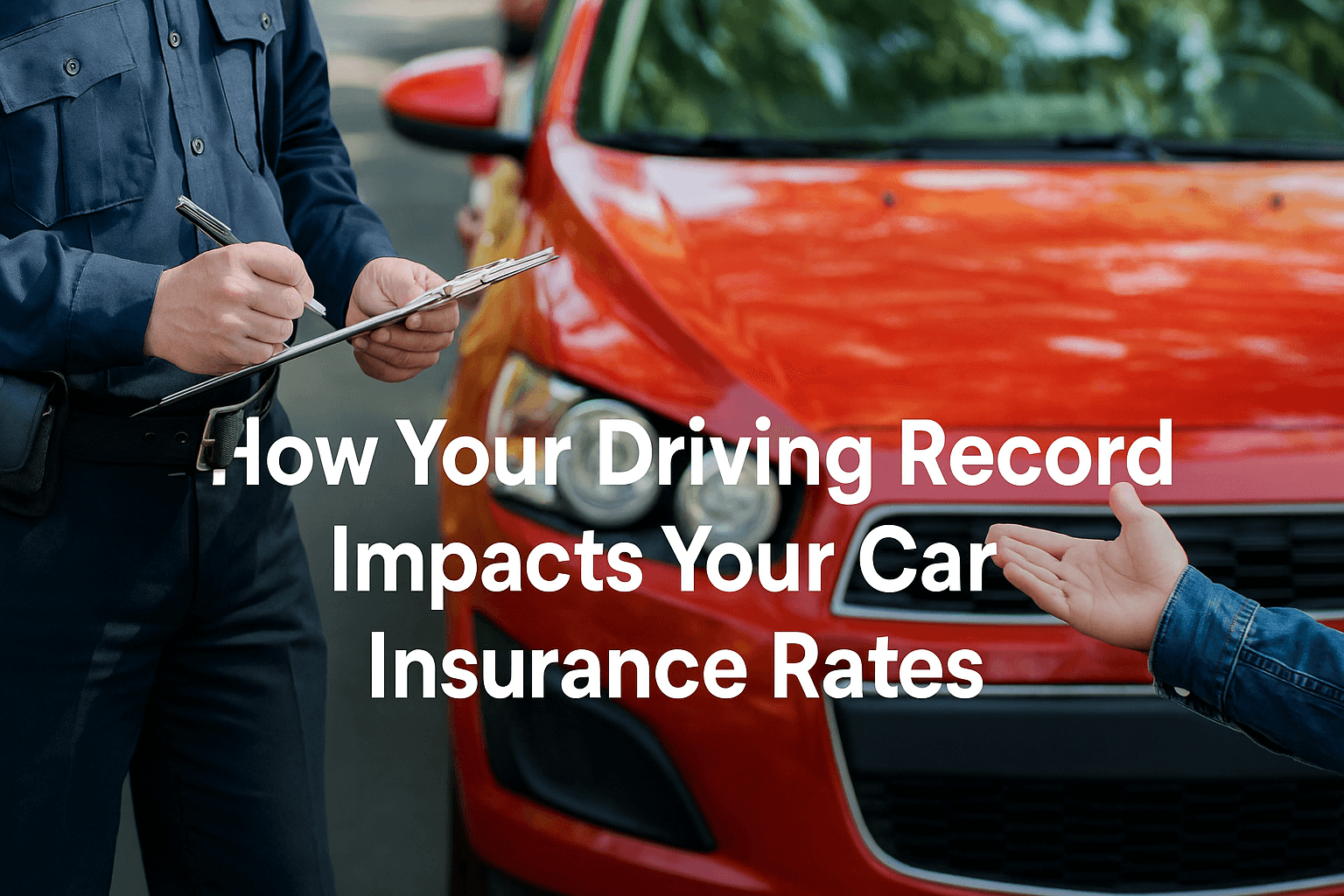

Legislators and regulators have encountered issues with cryptocurrencies. Pseudonymous and decentralized coins complicate implementation and oversight. Governments and regulatory agencies must combat fraud, money laundering, and tax evasion while promoting innovation. Investors and bitcoin businesses are uneasy due to the patchwork of laws created by the absence of a unified legal framework.

The environmental impact of cryptocurrency mining is another problem. It takes a lot of energy and processing power to mine energy-intensive cryptocurrencies like Bitcoin. The effects of mining on the environment have spurred conversations about sustainability and more environmentally friendly practices. To address these issues, initiatives such as energy-efficient consensus processes and renewable energy are being developed.

Cryptocurrencies also have an impact on traditional businesses, as blockchain technology is transforming a number of industries. For secure and effective financial transactions, banks and payment processors are looking into blockchain technology. Blockchain’s transparent, traceable data has increased supply chain management’s efficiency and decreased fraud. Blockchain technology is also being tested by the entertainment, healthcare, and real estate sectors in an effort to boost efficiency and grow their businesses.

Another important subject is how cryptocurrencies affect cross-border transactions and international trade. Compared to traditional banking, coins enable international transactions at reduced costs and with quicker settlement times. This effectiveness could facilitate international trade and economic integration, particularly in areas lacking traditional banking services.

Cryptocurrencies have the potential to revolutionize the market, but their influence on the world economy may be limited by a number of factors. Sharp price swings in the market continue to pose a threat to businesses and investors. Uptake and integration into traditional banking systems are hampered by regulatory uncertainty and environmental concerns.

In summary, cryptocurrencies have transformed financial markets, industries, and financial inclusion globally. Building decentralized financial services and integrating digital assets into financial institutions are two examples of the new opportunities and challenges brought about by this. Technology, banking, and commerce will probably be impacted by cryptocurrencies’ growing worldwide influence. Continuous comprehension of the benefits and drawbacks of virtual currency is necessary to preserve adaptability in a changing environment.